The Harshad Mehta Scam: India's Billion-Dollar White-Collar Crime

"It wasn't a scam, it was a masterstroke," said Harshad Mehta, India's notorious stockbroker who orchestrated one of the biggest financial frauds in the country's history. The Harshad Mehta scam, also known as the "securities scam," shook the nation and left a lasting impact on the financial sector. He was the "Big Bull" who rose from humble beginnings to become the kingpin of India's stock market in the 1990s. Harshad Mehta's life was a rollercoaster ride of glamour, wealth, and power, but it all came crashing down with one of the biggest financial scams in Indian history.

Poster from a series made on the life of Harshad Mehta | Source : Mint

"Risk hai to ishq hai", proclaimed Harshad Mehta, the "Big Bull" of the Indian stock market. But as the tale of his meteoric rise and catastrophic fall unfolds, it becomes clear that the risks he took were not just romantic notions of love, but reckless gambles that ultimately led to one of the biggest financial scams in Indian history.

The Harshad Mehta Scam, also known as the Securities Scam of 1992, shook the foundations of the Indian financial system and left thousands of investors devastated. It was a classic case of a man with humble beginnings who rose to the pinnacle of success, only to succumb to his own greed and ambition.

The story of the Harshad Mehta scam has been immortalized in the web series "Scam 1992: The Harshad Mehta Story." Let's take a closer look at the events that unfolded and the lessons that can be learned from them.

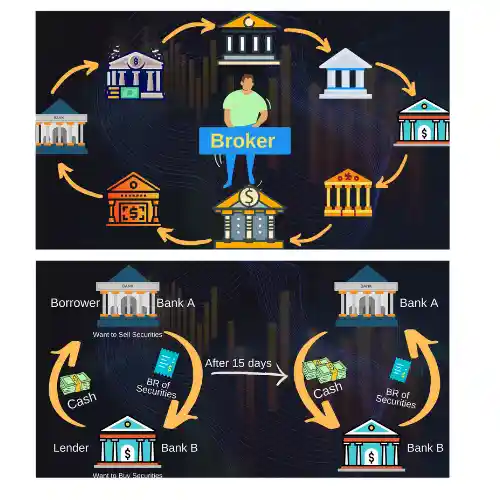

Harshad Mehta was born into a middle-class Gujarati family in 1961. He started his career as a jobber, buying and selling stocks on behalf of brokers. However, he soon realized that there was a huge gap between the price at which the banks were buying and selling government securities. He exploited this loophole in the system and started buying securities from banks using funds borrowed from other banks, inflating their prices, and then selling them at a higher price to make a profit.

Infographic explaining the whole scam | Source: Thorahatke

The scheme worked, and Mehta's wealth and influence grew rapidly. He lived a lavish lifestyle, complete with a fleet of cars, a sprawling bungalow, and a reputation as the "Amitabh Bachchan of the stock market."

However, Mehta's luck ran out when journalist Sucheta Dalal published an article in The Times of India in April 1992, exposing his fraudulent activities. This led to a domino effect, with other journalists and authorities investigating his actions.

Sucheta Dalal receiving the Padma Shri Award from the then President of India- Mr. APJ Abdul Kalam | Source: Wikipedia

Mehta was arrested in November 1992, and the scandal that unraveled showed the extent of his fraud. He had manipulated the stock market to the tune of Rs. 4,000 crore (about $500 million), using fake bank receipts and other illegal means. The scam had involved multiple banks, politicians, and brokers, and had taken place over several years.

The aftermath of the Harshad Mehta scam was devastating. Thousands of investors lost their life savings, and the Indian financial system was left in turmoil. The government had to step in to restore confidence in the markets, leading to significant reforms in the banking and financial sectors. The Harshad Mehta scam was a cautionary tale of the dangers of greed, ambition, and the need for regulation and transparency in the financial system. It showed that even a small loophole in the system can be exploited for personal gain, leading to catastrophic consequences.

This scam has left an indelible mark on Indian financial history, and it continues to be studied and discussed even today. It is a reminder that the pursuit of wealth and success should not come at the cost of ethical values and principles. The Harshad Mehta scam is not just a story of financial fraud, but it is also a story of the human condition, and it holds valuable lessons for all of us.